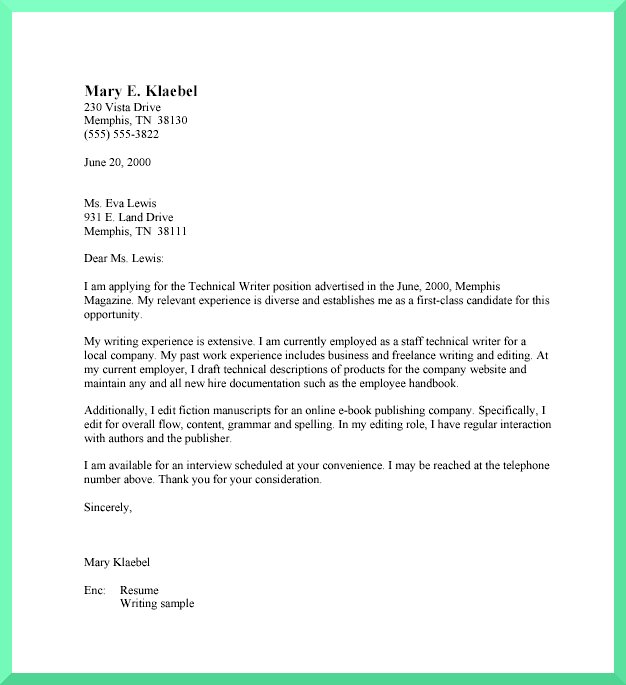

Loan Adjustment Request Letter for Auto Loan Sample

Second Sample:

Loan Adjustment Letter

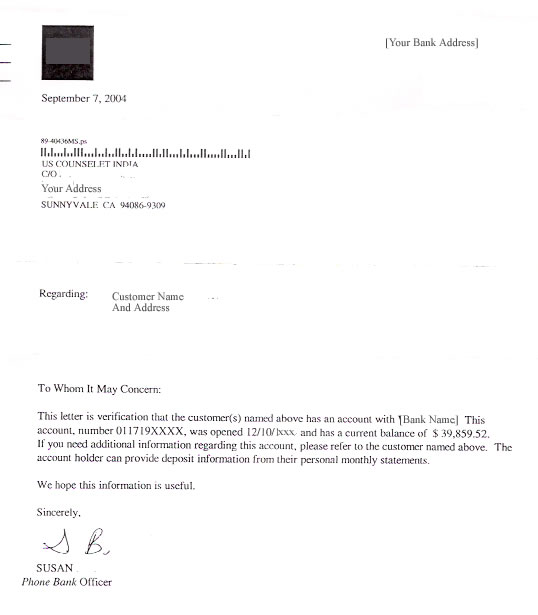

Detail of you and date and time

Dear Sir,

It is in reference to your letter No.BOP/THR/023 Dated January 10, 2024, regarding the above-cited subject.

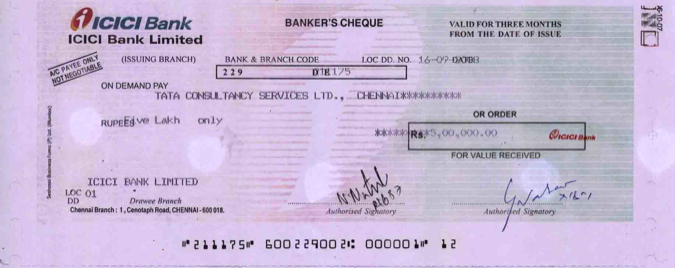

We are regularly adjusting the markup against the available facility of the loan. Since July 20, 2007, we have given you a markup amounting to Rs. 2, 3235565. Please adjust the markup amounting to Rs. 22325 against our cheque deposited in our account, and we will adjust the remaining markup for the quarter ending December 31, 2008, within the next seven days.

On July 20, 2007, we had a total outstanding loan liability of Rs. 11,4982125 payable to you. Still, we have given an adjustment amounting to Rs. 2,778,138.

As you know, the markup rates have increased too much, and such high financial charges are a heavy burden on the cash flow of every company. So to eliminate such heavy markup charges, we are determined to adjust the outstanding loan amount as early as possible. We assure you that we will adjust the outstanding balance of the loan facility within the next nine to ten months.

Thanking you, we remain.

about your Party